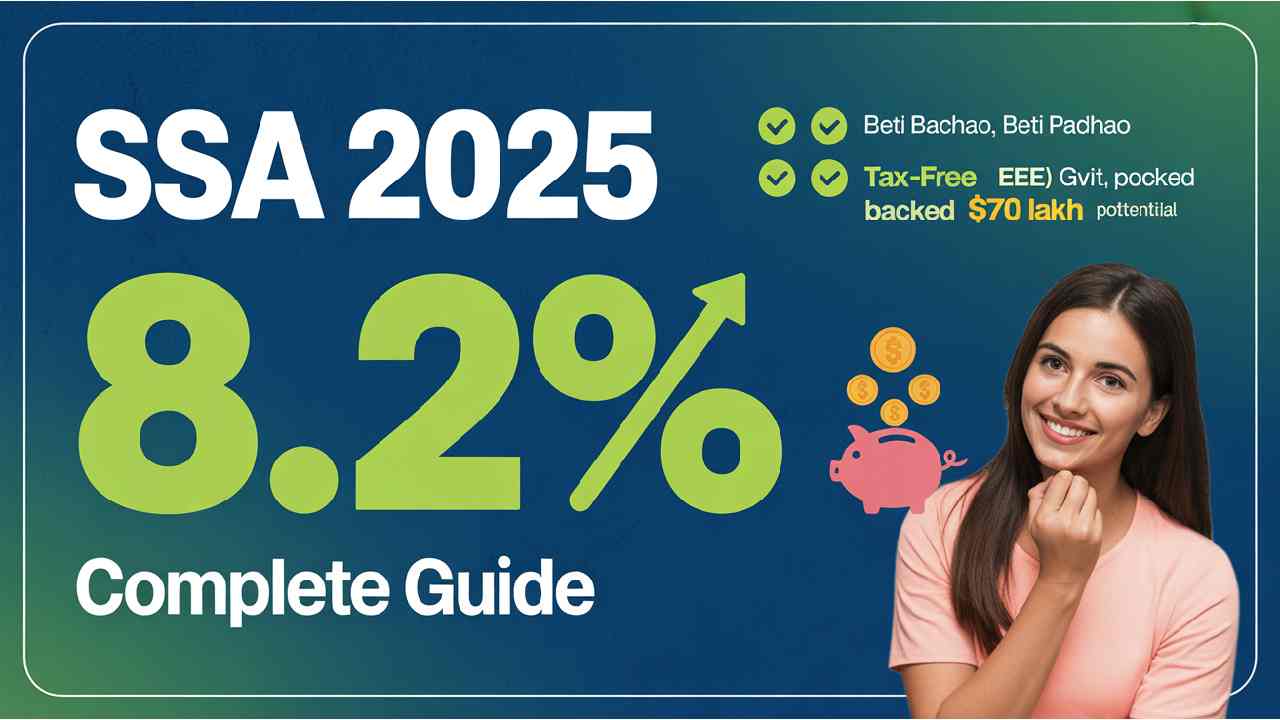

The Sukanya Samriddhi Account (SSA) or Sukanya Samriddhi Yojana (SSY) is one of the most popular savings schemes in India for securing the future of a girl child. It is a government-backed small savings scheme under the “Beti Bachao, Beti Padhao” campaign, launched in January 2015 by Prime Minister Narendra Modi. The scheme is designed to help parents build a strong financial fund for their daughter’s higher education and marriage.

In this blog, we will explain everything you need to know about Sukanya Samriddhi Yojana including features, interest rates, tax benefits, deposits, withdrawals, and maturity rules.

What is Sukanya Samriddhi Account?

The Sukanya Samriddhi Account (SSA) is a long-term savings account opened in the name of a girl child. The account can be opened at any post office or authorized bank (like SBI, PNB, HDFC, ICICI, etc.).

Parents or legal guardians can open this account for their girl child before she turns 10 years old. It allows regular deposits and earns attractive interest rates. The money can be withdrawn for her education or marriage after she becomes 18 years old.

In short, this scheme gives:

- High interest rate (currently 8.2% per year, Jan–Mar 2025)

- Tax-free savings

- Safe and guaranteed returns (because it is backed by the Government of India)

Key Features of Sukanya Samriddhi Account

Here are the main features explained in a simple way:

- Eligibility

- Account can be opened for a girl child below 10 years of age.

- Parents or legal guardians can open the account.

- A family can open up to two accounts, one for each daughter.

- Exception: In the case of twins or triplets, more than two accounts are allowed.

- Account can be opened for a girl child below 10 years of age.

- Deposit Rules

- Minimum deposit per year: ₹250

- Maximum deposit per year: ₹1.5 lakh

- Deposits can be made in one go or in multiple installments.

- Deposits are allowed for 15 years from the date of account opening.

- Minimum deposit per year: ₹250

- Tenure / Duration

- The account matures in 21 years from the date of opening.

- Deposits are only needed for 15 years, but the money keeps earning interest for the full 21 years.

- The account matures in 21 years from the date of opening.

- Interest Rate

- Current rate: 8.2% (Jan – Mar 2025).

- Interest is compounded yearly.

- Interest rates are decided every quarter by the Government of India.

- Current rate: 8.2% (Jan – Mar 2025).

- Withdrawal Rules

- After the girl turns 18 years, up to 50% of the account balance can be withdrawn for higher education.

- Full amount can be withdrawn for marriage after she turns 18.

- After the girl turns 18 years, up to 50% of the account balance can be withdrawn for higher education.

- Tax Benefits

- Investment is eligible for deduction under Section 80C of the Income Tax Act (up to ₹1.5 lakh).

- EEE Benefit (Exempt-Exempt-Exempt):

- Amount invested is tax-free.

- Interest earned is tax-free.

- Maturity amount is tax-free.

- Amount invested is tax-free.

- Investment is eligible for deduction under Section 80C of the Income Tax Act (up to ₹1.5 lakh).

- Account Transfer

- The account can be transferred anywhere in India if the family relocates.

- Transfer between post offices and banks is also allowed.

- The account can be transferred anywhere in India if the family relocates.

How to Open a Sukanya Samriddhi Account

Opening an SSA account is simple.

- Visit any SBI/Post Office/authorized bank branch.

- Fill out the SSA Account Opening Form.

- Submit the following documents:

- Birth certificate of the girl child

- Identity proof of parent/guardian (Aadhaar, PAN, etc.)

- Address proof

- Passport size photo

- Birth certificate of the girl child

- Make the minimum deposit of ₹250.

Once the account is opened, you will get a passbook with all transaction details.

Interest Rate History of Sukanya Samriddhi Account

The interest rate has changed several times since its launch. Here’s a quick look:

- 2014–15: 9.1%

- 2015–16: 9.2%

- 2016–17: 8.5% – 8.6%

- 2017–18: 8.1% – 8.4%

- 2018–19: 8.1% – 8.5%

- 2020–23: 7.6%

- 2023–24: 8.0% – 8.2%

- 2025: 8.2% (current)

This shows that SSA always gives higher interest than normal savings accounts and many fixed deposits.

Benefits of Sukanya Samriddhi Account

- Financial security for the girl child – Parents can build a good fund for her future.

- High returns – Much better interest rate than bank FDs.

- Triple tax benefit – No tax on investment, interest, or maturity amount.

- Flexibility – You can deposit any amount between ₹250 and ₹1.5 lakh annually.

- Safe investment – 100% backed by the Government of India.

- Partial withdrawal – Money can be used for higher education at age 18.

- Nationwide availability – Account can be opened and operated anywhere in India.

Example: How Much You Can Save

Let’s assume you deposit ₹1.5 lakh every year for 15 years.

- Total deposit: ₹22.5 lakh

- Maturity value (approx.): ₹65–70 lakh (depending on interest rates)

This means your daughter can have a strong fund for higher studies or marriage by the time she turns 21.

You can also use a Sukanya Samriddhi Calculator to check exact returns (available on Groww, SBI, and NSI websites).

Withdrawal Rules in Detail

- Higher Education:

- 50% of balance allowed after age 18.

- Proof of admission to an educational institution is required.

- 50% of balance allowed after age 18.

- Marriage:

- Full withdrawal allowed once the girl turns 18.

- Proof of age and marriage must be submitted.

- Full withdrawal allowed once the girl turns 18.

- Premature Closure:

- Allowed in case of death of the account holder.

- In extreme situations like medical emergencies.

- Allowed in case of death of the account holder.

Tax Benefits Explained

The Sukanya Samriddhi Yojana is one of the very few schemes that offers EEE (Exempt-Exempt-Exempt) status.

- Investment – Deduction up to ₹1.5 lakh under Section 80C.

- Interest earned – Fully exempt from tax.

- Maturity amount – Completely tax-free.

This makes SSA one of the best tax-saving instruments in India, even better than FDs or RDs.

Sukanya Samriddhi vs Other Saving Schemes

| Feature | Sukanya Samriddhi Account | PPF | Fixed Deposit |

| Interest Rate | 8.2% | 7.1% | 6–7% |

| Tax Benefit | EEE (80C + tax-free maturity) | EEE | Only 80C, interest taxable |

| Tenure | 21 years | 15 years | 1–10 years |

| Purpose | Girl child’s future | General savings | General savings |

Clearly, SSA is the best scheme for parents with daughters.

Common Mistakes to Avoid

- Not depositing the minimum ₹250 in a year (account may become inactive).

- Forgetting to pay the penalty of ₹50 for late deposits.

- Not keeping track of maturity date.

- Withdrawing money before 18 years without valid documents.

Frequently Asked Questions (FAQ)

Q1: Can I open Sukanya Samriddhi Account online?

No, currently the account must be opened by visiting a post office or bank branch. But deposits can be made online via internet banking.

Q2: How many accounts can a family open?

A maximum of two accounts, one for each daughter. In case of twins/triplets, three accounts are allowed.

Q3: What is the current interest rate of Sukanya Samriddhi Account?

As of Jan–Mar 2025, the interest rate is 8.2% per annum.

Q4: Can the account be transferred if we move to another city?

Yes, SSA can be transferred anywhere in India between banks and post offices.

Q5: Is the maturity amount taxable?

No, both interest and maturity amount are 100% tax-free.

Q6: What happens if I don’t deposit money for a year?

The account becomes inactive. You can reactivate it by paying the missed minimum deposit + ₹50 penalty per year.

Q7: Can the girl operate her account?

Yes, once she turns 18, she can operate the account herself.

Conclusion

The Sukanya Samriddhi Account is one of the best government savings schemes in India. It not only helps parents save for their daughter’s future but also offers high returns, tax benefits, and complete safety.

If you are a parent of a girl child under 10 years, you should definitely open this account. With just ₹250 minimum deposit per year, you can secure her future education and marriage expenses.

For the latest updates, always check the official website: www.nsiindia.gov.in

Also read-SBI Pre-Approved Personal Loan: Get Instant Loan on YONO in Just 4 Clicks